401(k) Rollover Real Talk

RetireWhether you’re leaving your first job or about to start your tenth, here’s something you should know: Your 401(k) won’t automatically be coming along for the ride. So, what should you do?

Below we provide tips about how to roll over a 401(k) so your retirement funds can potentially grow alongside your career accomplishments. Here’s how to put your mind at ease during that first week at your new job:

When it comes to rolling over, you have options:

- If your 401(k) balance is modest (less than $5,000 for some plans), your former employer may remove you from their plan and send you a check for the total funds. Keep in mind that not all plans are the same, so it’s important to understand your specific cash-out conditions. If you receive a check, you can either deposit this money into an individual retirement account (IRA) or your new employer’s 401(k) plan—this is commonly referred to as “rolling over” that amount.

- Rolling your funds over into a new account should be easy and comes with tax advantages. But keep in mind, you’ll only have 60 days to deposit the check into your new fund or the IRS will treat this money as income, so it’s critical to make a plan for that money as soon as possible.

- If your balance is higher (typically above that $5,000 threshold) and you leave your job, your 401(k) can stay where it is. However, you probably won’t be able to make additional contributions nor will you enjoy the benefit of employer matching and monthly maintenance fees will still be deducted from your account. There are advantages and disadvantages to all rollover options; you are encouraged to review your options to determine if staying in a retirement plan, rolling over to an IRA, or another option is best for you.

Rolling over your 401(k) can help you stay organized.

If you have multiple 401(k) accounts with various employers, it can be hard to keep track of them all. Consolidating previous 401(k) plans is one way for you to stay on top of your retirement while potentially saving on maintenance fees. With the average 401(k) maintenance fee falling anywhere from below 1% all the way up to 2% per year,1 the fewer accounts you’re paying fees on the better. It is imperative to understand the nuances of your plans and the costs associated with opening and/or closing accounts so you can maximize your funds.

However, if you love your previous employer’s plan—perhaps the fees are low or the rates are amazing—you do not have to roll over. Just make sure you continue to monitor your plan. As other options are available, you are encouraged to review all of your options to determine if combining your retirement accounts is suitable for you.

Choose where you would like your rollover to go.

If your new employer offers a 401(k), a rollover can usually be done over the phone. First, you would set up an account with your new employer. Then, you would need to call your previous employer with your new account information on hand. This needed information will likely include the new account number, how to get the funds to the new account, and whether you need wire instructions or an overnight mailing address. Your new account provider should be able to get you that information easily.

In this case, you will have to be the one initiating the move through your previous employer. If the plan you are leaving makes it more difficult, you just need to know all of their requirements before they send your money to the new account.

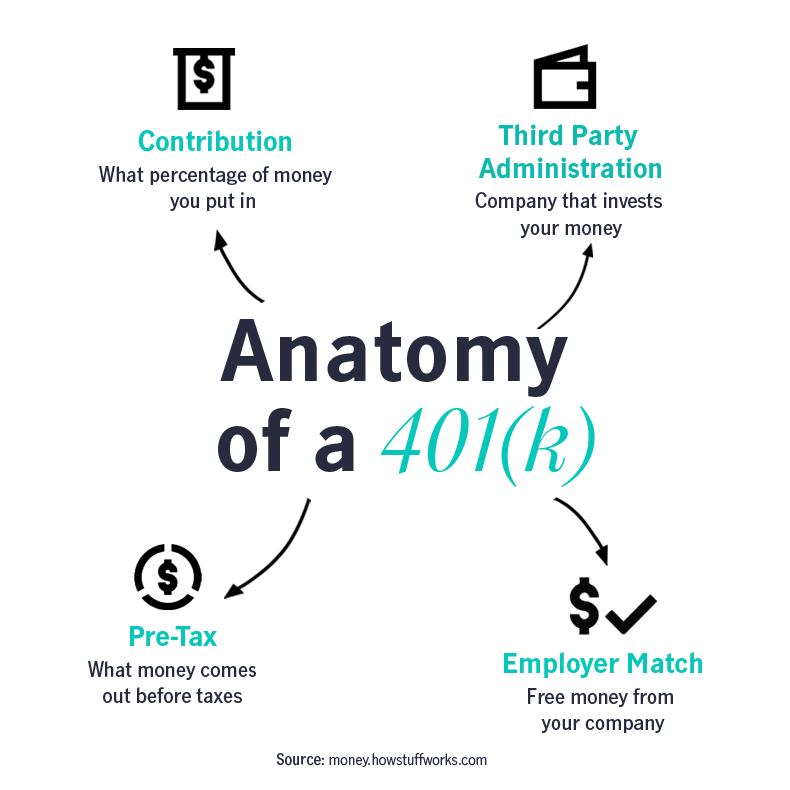

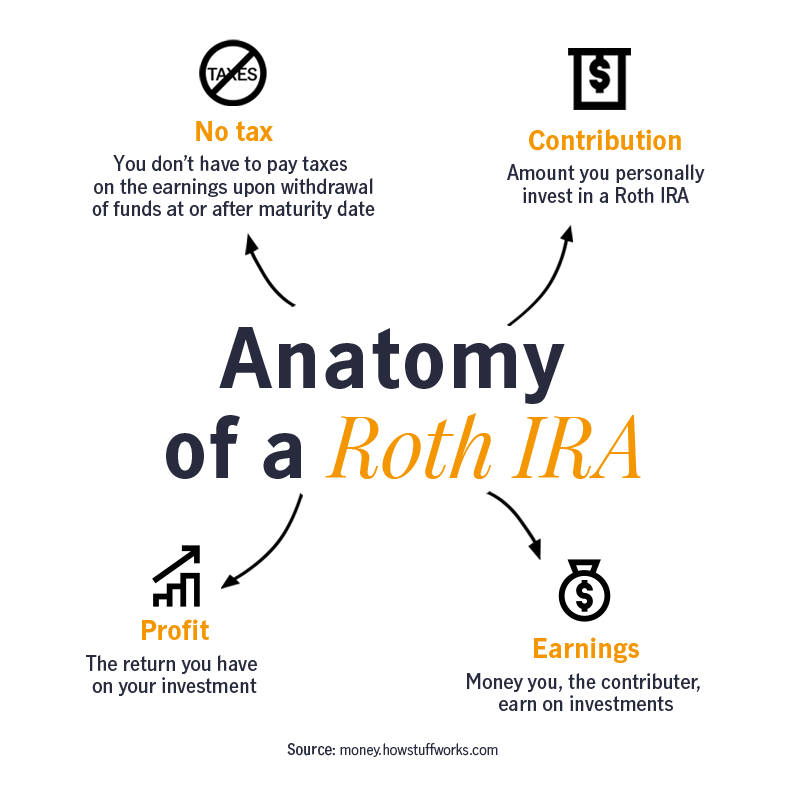

If your new employer doesn’t offer a 401(k), or you don’t like their current plan, you can roll your 401(k) into a traditional IRA or a Roth IRA. Both are individual retirement plans with the main difference being their tax structure: With a traditional IRA, you pay taxes only upon withdrawal. Whereas a Roth IRA is funded by your after-tax money, allowing for tax-free disbursements. If you convert your traditional 401(k) balance to a Roth IRA, you will need to pay taxes on the entire amount. Depending on your retirement time frame and balance, it may be worth discussing with a financial advisor.

Even if you don’t know where your career will go next, investing in a 401(k) can be one of the most powerful and reliable ways to reach your retirement goals.

Citations:

1 Business Insider: “An 'expensive' 401(k) fee is around 2%, but most people have no idea what they're paying” by Eric Rosenberg, August 7, 2019

MGR111419503544