LifeCare: Live well today, protect tomorrow

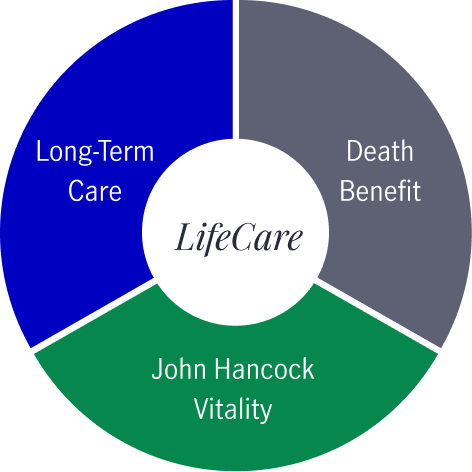

John Hancock's LifeCare, life insurance with long-term care benefits1, may help protect your assets and your independence while fully embracing the life you’re living today.

Create a plan for a more secure future with LifeCare

Growth potential that helps protect your future

LifeCare’s benefits have the potential to grow over time, helping protect your retirement assets and income from being depleted by care costs. And if you never need long-term care, your loved ones can receive a meaningful, tax-free death benefit.2

Flexible coverage tailored to you

LifeCare lets you choose how you receive benefits — whether at home or elsewhere — so you may maintain your independence and dignity, while also easing the emotional and financial burden on your family.3

A lever of control for living a longer, healthier, better life

By electing John Hancock Vitality PLUS and participating in the program, you may increase your policy’s death benefit and earn additional rewards for your everyday healthy choices — giving you greater control over your financial security and well-being.

Leverage one asset to help protect the others

By allocating a portion of your low yielding assets or income to purchase LifeCare, you’re securing both income tax-free long-term care protection and an income tax-free death benefit.2

This strategic move may help safeguard your retirement plans and give you greater control over your future and help you live your best life for years to come.

Learn more about LifeCare

As an indexed universal life insurance product with long-term care benefits, LifeCare provides guaranteed coverage along with flexibility to help meet your specific needs, so you may plan and help protect the future you desire while fully embracing the life you're living today.

Approved for use with consumers.

Why John Hancock?

More than 160 years of experience and stability

So you may trust in our ability to deliver on our promises and be there when our customers need us most.

Knowledgeable professionals providing expert guidance

To help you navigate your options and make informed decisions when care is needed.

The John Hancock Vitality program

A program that gives you the opportunity to earn rewards and receive support for making healthy choices, helping you live your best life for years to come.

Looking for more?

About us

For over 160 years, we’ve been helping our partners build their life insurance businesses and helping their clients protect what matters most.

Explore Insure

You can learn more about other types of life insurance that may align with you goal and needs here.

Prepare for better

Explore the 2025 Longevity Preparedness Index insights to help you prepare for a longer, healthier, better life.

THE PURPOSE OF THIS COMMUNICATION IS THE SOLICITATION OF INSURANCE. CONTACT MAY BE MADE BY AN INSURANCE AGENT OR INSURANCE COMPANY.

1. The LifeCare product offers two long-term care riders. The LifeCare Long-Term Care rider does not offer guaranteed increases in long-term care benefits, however the long-term care benefit balance may grow as a result of increases in the life insurance policy death benefit resulting from positive policy performance. The LifeCare Long-Term Care Inflation rider benefit balance is not impacted by increases in the death benefit but includes 5% increases in your long-term care benefit each year. The fixed premium for the LifeCare Long-Term Care Inflation rider is higher than the fixed premium for the LifeCare Long-Term Care rider.

2. Life insurance death benefit proceeds are generally excludable from the beneficiary’s gross income for federal income tax purposes. There are a few exceptions such as when a life insurance policy has been transferred for valuable consideration. In addition, state and estate taxes may apply in certain instances. The long-term care benefits are designed to be excludable from gross income under federal tax law; however, there might be situations in which the benefits or premiums for these riders are taxable.

3. You will work with your Licensed Health Care Provider to determine the appropriate setting to receive care.

The LifeCare Long-Term Care Rider and the LifeCare Long-Term Care Inflation Rider accelerate the death benefit for approved long term care expenses and, depending on the benefit period selected, also offer an extension of long-term care benefits after the death benefit has been fully accelerated. When the death benefit is accelerated for long-term care expenses, it is reduced dollar for dollar, and the cash value is reduced proportionately. The riders have a maximum monthly benefit amount and are subject to underwriting. The benefits provided by these riders are designed to be excludable from gross income under federal tax law; however, there might be situations in which the benefits or premiums for these riders are taxable. There are additional fixed premiums associated with these riders. The riders have exclusions and limitations, reductions of benefits, and terms under which the rider may be continued in force or discontinued. Please contact a licensed insurance producer or John Hancock for more information, cost, and complete details on coverage. John Hancock’s Long-Term Care riders are not Partnership Qualified products. For more information on Partnership Qualified products, please contact your state department of insurance.

The amount of benefits correspond with the premium.

To be eligible for long-term care benefits, the insured must be a Chronically Ill individual due to cognitive impairment or the inability to perform at least 2 activities of daily living for at least 90 days, with qualified long-term care services provided pursuant to a plan of care prescribed by a licensed health care practitioner.

Comments on taxation are based on John Hancock’s understanding of current tax law, which is subject to change. No legal, tax or accounting advice can be given by John Hancock, its agents, employees or licensed agents. Prospective purchasers should consult their tax professional for details.

The life insurance policy describes coverage under the policy, exclusions and limitations, what you must do to keep your policy inforce, and what would cause your policy to be discontinued. Please contact your licensed agent or John Hancock for more information, costs, and complete details on coverage to help you determine if this policy is suitable for your needs. Availability of policies, features, and benefits may vary by state.

Vitality is the provider of the John Hancock Vitality Program in connection with polices issued by John Hancock. John Hancock Vitality Program rewards and discounts are available only to the person insured under the eligible life insurance policy, are subject to change and are not guaranteed to remain the same for the life of the policy. To be eligible to earn rewards and discounts by participating in the Vitality program, the insured must register for Vitality and in most instances also complete the Vitality Health Review (VHR).

Products or services offered under the Vitality Program are not insurance and are subject to change. There may be additional costs associated with these products or services and there are additional requirements associated with participation in the program. For more information, please contact the company at JohnHancock.com or via telephone at 888-333-2659.

Insurance policies and/or associated riders and features may not be available in all states. Some riders have additional premiums and expenses associated with them. This material is for informational purposes only and is not investment advice or a recommendation.

LifeCare is not available in California or New York.

Guaranteed product features are dependent upon minimum premium requirements and the claims-paying ability of the issuer.

Insurance products are issued by John Hancock Life Insurance Company (U.S.A.), Boston, MA 02116.

ICC25 LIFE1700WEB

MLI111825929-1

Policy Form Series:

ICC24 24LifeCare; 24LifeCare

Rider Form Series:

ICC24 24LTCR-NIP; 24LTCR-NIP

ICC24 24LTCR-IP; 24LTCR-IP

ICC24 24HEBR; 24HEBR