Should you buy life insurance for family members?

Insure

Key Takeaways:

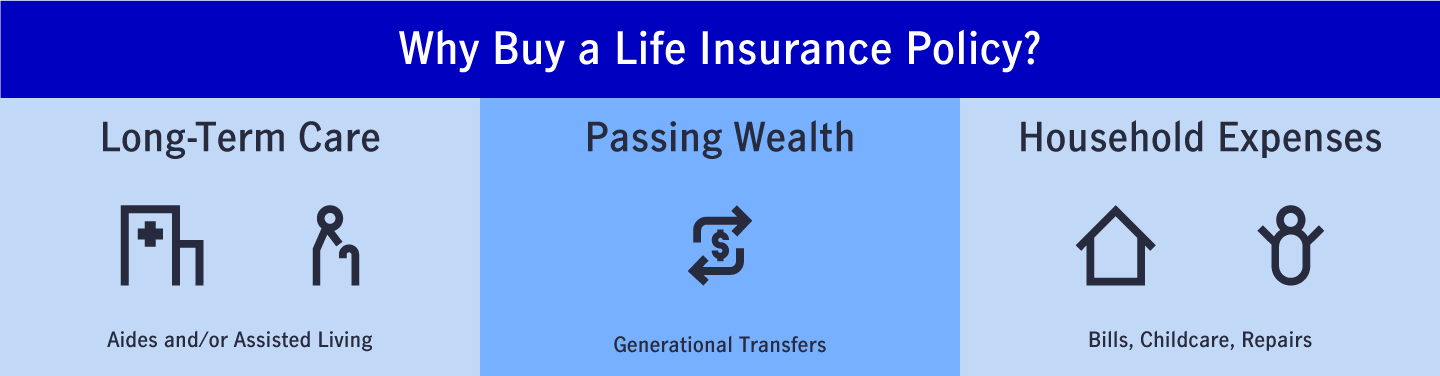

- To purchase life insurance for someone else, you need to prove that they have insurable interest (financial loss and hardship should the insured person pass away).

- Life insurance for a spouse can help ease the financial burden of lost income, childcare or running a household.

- Purchasing a policy for a parent can help ensure an inheritance for future generations, or cover expenses such as long-term care or estate taxes.

- Purchasing a policy for a child can help ensure they are medically eligible for insurance or can be used as a vehicle to pass wealth to future generations.

- If a sibling is supporting your parents, or if they face health issues that may result in unpaid expenses, life insurance can help protect your finances if responsibility passes to you.

We all want our families to be financially secure, especially in the unlikely event that we aren’t there to provide for them. That’s why we buy life insurance policies for ourselves. But sometimes it’s also a good move to get plans for other family members.

Keep in mind—you can’t just purchase a life insurance plan for anyone. An individual buying a policy for someone else must prove that they have insurable interest. That means that the person making the purchase is able to demonstrate that they would face financial loss and hardship should the insured individual pass away. The insurance company will ask for proof and investigate the relationship between the beneficiary and insured before signing off on the policy.1

Additionally, in order to take out a life insurance policy on someone else, you have to get their consent. They must be willing to cooperate throughout the application process (even if you’re the one paying for the policy). This typically includes agreeing to a medical exam as well as answering application questions themselves. If they are unwilling to participate in any step, you will not be able to take out a policy on them.2

So, which family members might you consider purchasing a plan for? Here’s a quick breakdown to help you decide:

Spouse

Purchasing life insurance for a spouse is generally considered a smart move. Many people opt to secure coverage for their family’s primary breadwinner. That way, in the wake of a premature death, they are able to replace the lost income that they depend upon. But it also can be a good idea to insure a non-earning spouse as well. After all, these individuals devote a lot of energy to running a household—be it providing childcare, cooking meals, overseeing repairs, etc. In the event of their passing, it’s often necessary to pay someone to cover these tasks and services. And it might be difficult for some people to manage these unexpected expenses. An insurance payout should alleviate at least some of that financial burden.3

Parent

Unlike a spouse, buying a life insurance plan for a parent (or grandparent) is typically less of a priority. This is because people don’t often depend on elder relatives for financial support in the same way they do a partner. Nevertheless, there are circumstances in which it makes sense to take out a policy on your parents. Some do so in order to help ensure an inheritance for the next generation. They may also want to use life insurance money to pay for estate fees or funeral expenses, which can be quite high.4 Additionally, there are times when the surviving parent is unable to live alone. The funds from a life insurance policy can be used to move them into an assisted living facility or to pay for necessary aides.5

Child

Most families don’t depend on their children for their financial well being. So why would anyone buy life insurance for their child? Well, some parents do as part of a broader financial plan to pass wealth to their dependents. After all, some policies have a cash account that grows over time (though there may be better investment vehicles to build their college fund/nest egg). They might also be motivated to lock in a plan at a lower premium. This is especially true for parents who have children with medical conditions. These individuals often purchase a plan while their child is still a minor to ensure that their son or daughter has coverage when they reach adulthood.6

Sibling

It’s definitely less common for someone to take out an insurance policy on a sibling. After all, you’re not as likely to have insurable interest on your sister or brother. However, there are cases where it makes sense to consider. For example, say your brother has taken on the responsibility of caring for your parents. A life insurance policy would help you cover costs of elder care should he pass away unexpectedly.7 Similarly, if your sibling has chronic health issues or disabilities or if they’ve faced long-term unemployment, the money you receive would help cover any expenses they leave behind.8

Discussions about life insurance are an important part of your regular financial planning. Taking time to consider family members for whom you might want to purchase a policy can help ensure your family’s financial wellbeing in the face of the unexpected.

Citations:

1 ValuePenguin: “What is Insurable Interest in Life Insurance?” by Sterling Price, September 17, 2020 https://www.valuepenguin.com/insurable-interest-life-insurance

2 Policygenius: “Can you take out a life insurance policy on someone else?” by Nupur Gambhir & Rebecca Shoenthal, December 7, 2020 https://www.policygenius.com/life-insurance/can-you-take-out-a-life-insurance-policy-on-someone-else/

3 Nerdwallet: “Find the Best Life Insurance for Your Family” by Georgia Rose, May 29, 2020 https://www.nerdwallet.com/blog/insurance/family-life-insurance/

4 Nerdwallet: “Find the Best Life Insurance for Your Family” by Georgia Rose, May 29, 2020 https://www.nerdwallet.com/blog/insurance/family-life-insurance/

5 Money Under 30: “Buying Life Insurance For Your Parents? - Here's What You Need To Know” by Shanah Bell, October 20, 2020 https://www.moneyunder30.com/buying-life-insurance-for-your-parents

6 Policygenius: “Should you buy life insurance for children?” by Jeanine Skowronski & Patrick Hanzel, CFP, July 24, 2020 https://www.policygenius.com/life-insurance/life-insurance-for-children/

7 Policygenius: “Can you take out a life insurance policy on someone else?” By Nupur Gambhir & Rebecca Shoenthal, December 7, 2020 https://www.policygenius.com/life-insurance/can-you-take-out-a-life-insurance-policy-on-someone-else/

8 Life-Wealth-Win: “Can I Get Life Insurance on My Siblings?”

Financial planning and investment advice provided by John Hancock Personal Financial Services, LLC (“JHPFS”), an SEC registered investment adviser. Investments: notFDIC insured – No Bank Guarantee – May Lose Value. Investing involves risk, including loss of principal, and past performance does not guarantee future results.Diversified portfolios and asset allocation do not guarantee profit or protect against loss. Nothing on this site should be construed to be an offer, solicitation of an offer, orrecommendation to buy or sell any security. Before investing, consider your investment objectives and JHPFS’s fees. JHPFS does not provide legal or tax advice andinvestors should consult with their personal legal and tax advisors prior to purchasing a financial plan or making any investment.

Insurance products are issued by John Hancock Life Insurance Company (U.S.A.), Boston, MA 02116 (not licensed in New York), and John Hancock Life Insurance Company of New York, Valhalla, NY 10595.

MLINY121620041-1