3 reasons to prioritize saving for retirement

Retire

Retirement can seem so far away when you first enter the workforce. So, it’s natural to focus on the present when you have more immediate goals like moving to a new apartment, building an emergency fund or travelling. Prioritizing saving, the earlier the better, can set you on a path to living your best life in retirement- and maybe even an early departure from the workforce. According to a poll conducted by MoneyRates, people who began saving in their 20s were 66% more likely to be on track to retire by 60.1

Here are three real benefits to saving for retirement now:

1. Profit from compound interest

When it comes to your retirement savings, you’ll find no better ally than compound interest. Why? It helps gives your nest egg a serious boost since it allows you to earn interest on your interest.2

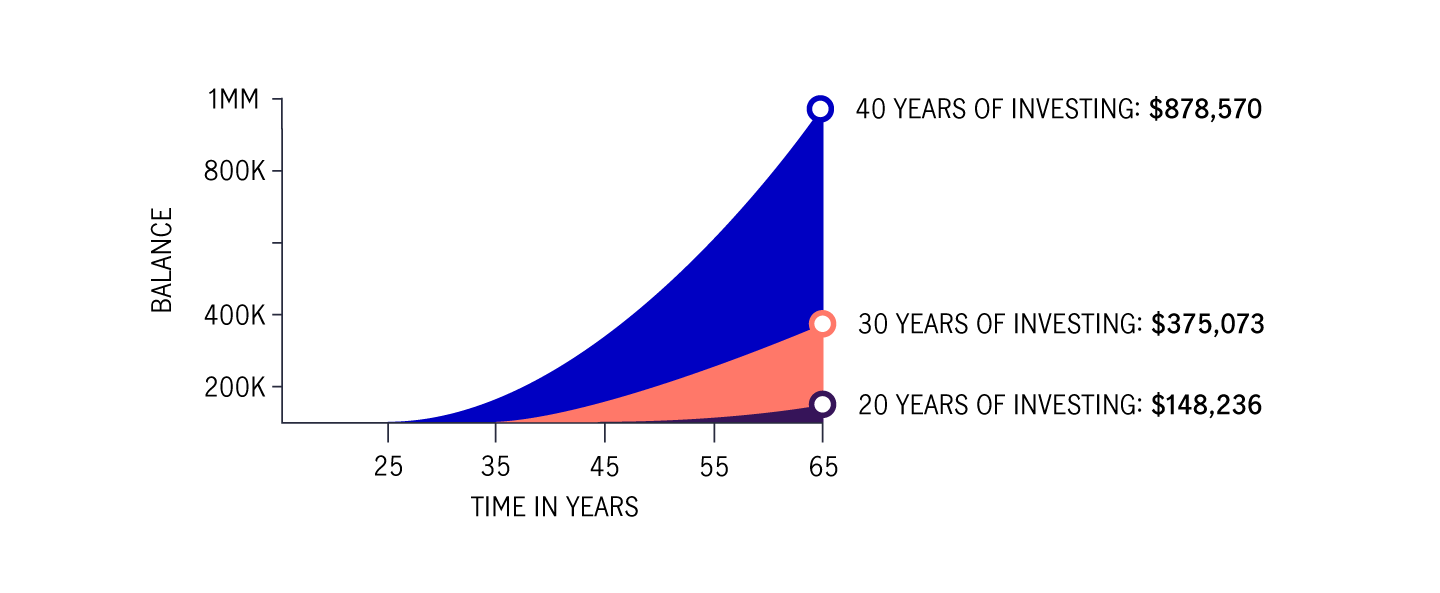

We’ll break it down with an example: let’s say you invest $250 a month into a retirement account, with an average annual return of 8%. You end up retiring around the age of 65. How much money will you have managed to stash away by then?

- If you started investing at 25: you will have $878,570 accumulated

- If you started investing at 35: you will have $375,073 accumulated

- If you started investing at 45: you will have $148,236 accumulated

That’s no small difference. By starting early, you’re taking full advantage of compound interest and making your money work every bit as hard as you do.

This is a hypothetical example based on information found in the following article. Investing involves risk, including loss of principal, and past performance does not guarantee future results. Diversified portfolios and asset allocation do not guarantee profit or protect against loss.

2. Protect Yourself Against Market Risk

When you put money into a 401k or IRA account, you’re actually investing in the stock market – which has natural ups and downs. Fortunately, if you begin saving for retirement early, you can cushion yourself against some of this volatility. Your finances will be able to handle these dips because you’ll have plenty of time to ride out any short-term losses. This means that you can take more aggressive action with your portfolio and potentially yield higher returns.3 As you get closer to retirement, that’s when you’ll start shifting from growing your wealth to protecting all that you’ve saved.4

3. Practice Financial Discipline

Chances are, you’re working steadily towards a few different financial goals, such as making a big purchase or starting a family. While it’s understandable to prioritize more immediate milestones, it’s also a good idea to work retirement into your regular savings plan. The amount you’re able to set aside is less important than the simple act of saving. If you make saving a habit, you can create momentum and quickly begin building up your fund.5 Regular saving can become as commonplace as paying a monthly credit card bill.

Prioritizing saving for retirement is doing your future self a huge favor – and helps ensure that retirement is some of the best years of your life. It might even enable you to retire early. All it takes is some smart financial planning.

Citations:

1 MoneyRates: “Study - Saving Before 30 Greatly Improves Outlook for Early Retirement” by Richard Barrington, February 6, 2015 https://www.money-rates.com/research-center/early-retirement-savings.htm

2 Business Insider: “Every 25-Year-Old In America Should See This Chart” by Sam Ro, March 21, 2014 https://www.businessinsider.com/compound-interest-retirement-funds-2014-3?op=1

3 Morningstar: “How Much Risk Should I Take When Investing?” by Michael Schramm, January 20, 2020

4 U.S. News: “How to Cope With Stock Market Declines in Retirement” by Emily Brandon, March 15, 2018 https://money.usnews.com/money/retirement/401ks/articles/2018-03-05/how-to-cope-with-stock-market-declines-in-retirement

5 Forbes: “9 Financial Habits That Can Make You Wealthy” by Marisa Torrieri, May 13, 2014 https://www.forbes.com/sites/learnvest/2014/05/13/9-financial-habits-that-can-make-you-wealthy/#7a75f3e47183

Financial planning and investment advice provided by John Hancock Personal Financial Services, LLC (“JHPFS”), an SEC registered investment adviser. Investments: not FDIC insured – No Bank Guarantee – May Lose Value. Investing involves risk, including loss of principal, and past performance does not guarantee future results. Diversified portfolios and asset allocation do not guarantee profit or protect against loss. Nothing on this site should be construed to be an offer, solicitation of an offer, or recommendation to buy or sell any security. Before investing, consider your investment objectives and JHPFS’s fees. JHPFS does not provide legal or tax advice and investors should consult with their personal legal and tax advisors prior to purchasing a financial plan or making any investment.