Your debt diagnosis

Finance 101

Almost everyone has debt. In fact, debt.org estimates that 80% of Americans have some sort of debt.1 But what kind of debt and how much varies greatly from person to person, and as a result, so can the options to deal with it.

This article can help you calculate your debt-to-income (DTI) ratio, determine where you fall on the scale, and give you practical tips to help manage your debt.

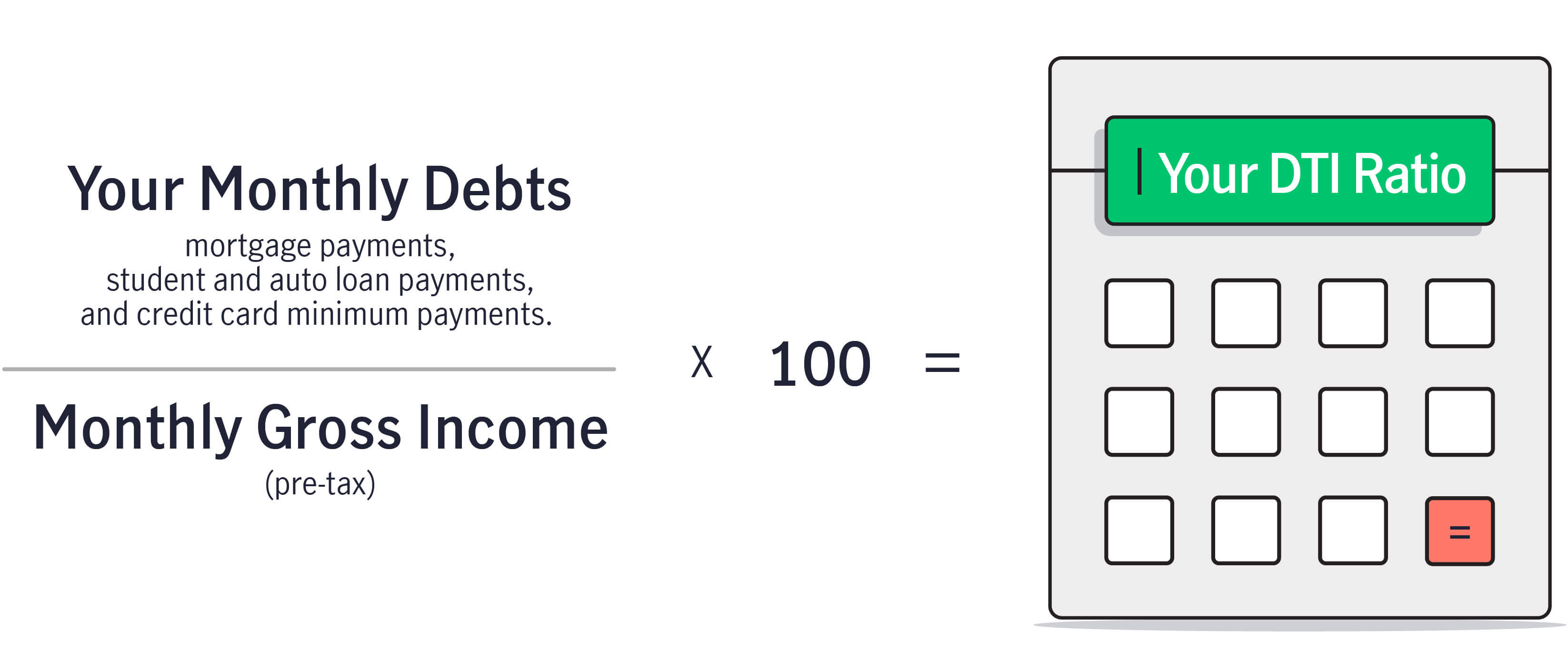

To calculate your DTI ratio, you simply take your monthly debt and divide it by your monthly gross income. This number is important because it can be a reflection of your financial health and something lenders may often look at to determine if lending you money is worth the risk.

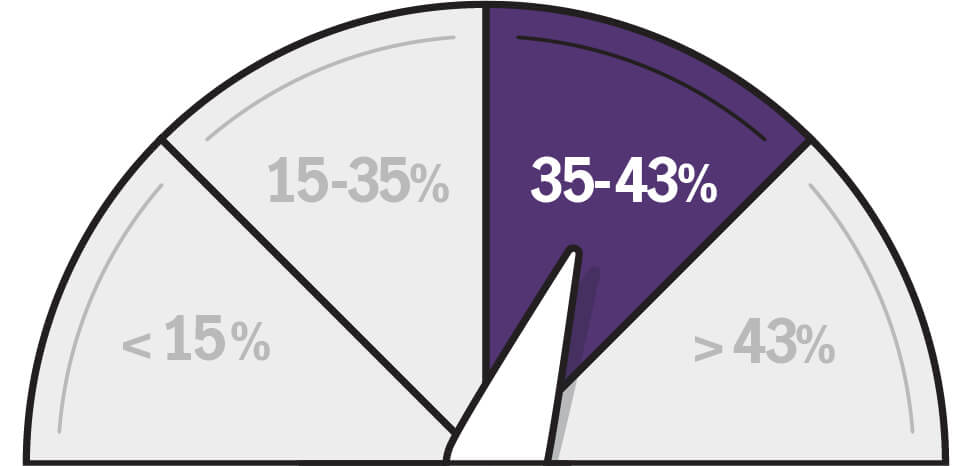

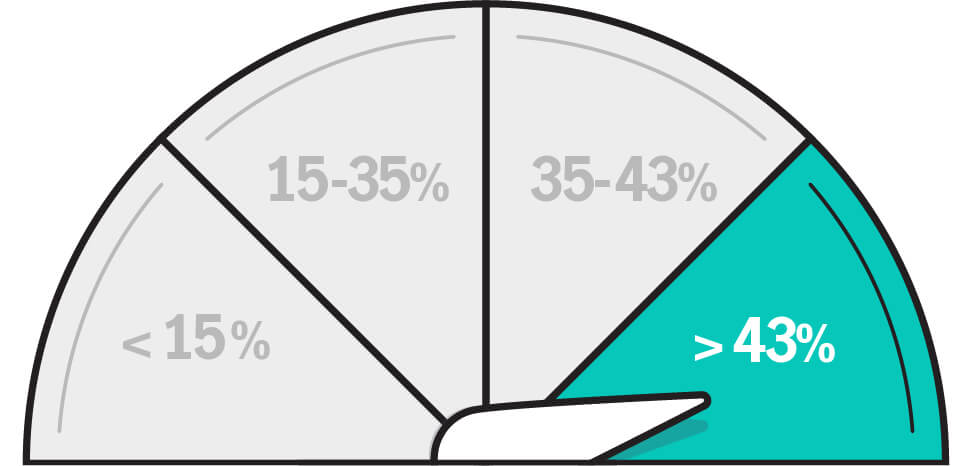

For example, if your monthly debts add up to $1,700 and your gross monthly income is $4,300, your DTI ratio would be 39.5%. [1,700/4,300 = 0.395]

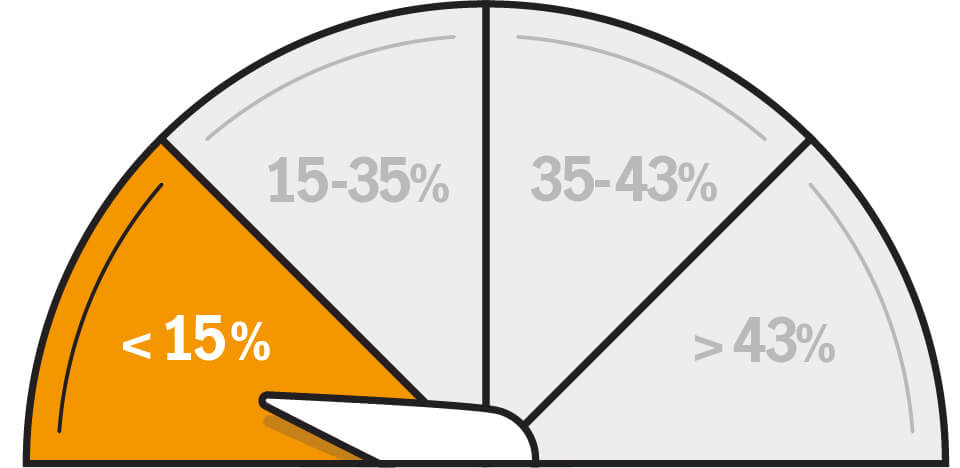

Now that you've calculated your DTI ratio, you will want to analyze where you fall on the scale?

The Picture of Debt Health

Congrats! You’ve done a great job keeping a low DTI ratio. Keep up the good work! When considering taking on any new debt, such as a mortgage or a personal loan, use the calculator to evaluate how it might affect where you fall on the scale.

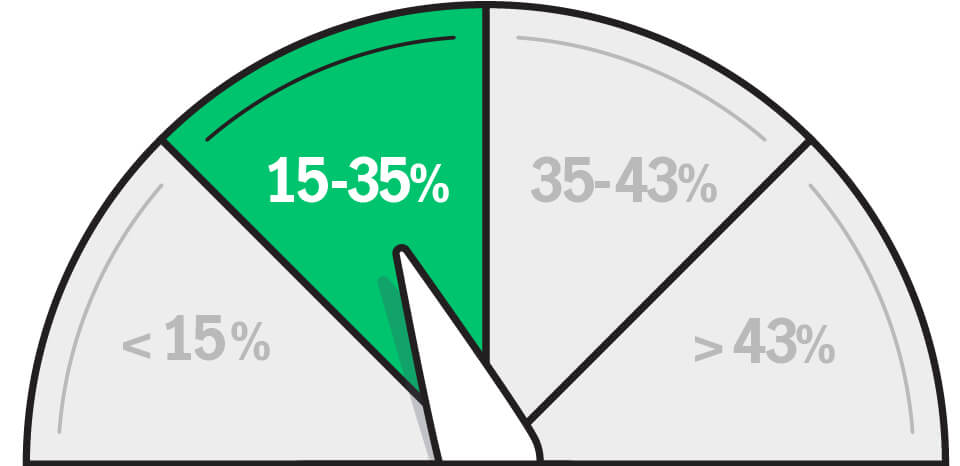

Fairly Fit Debt

It’s okay to have some debt, and a DTI ratio of 36% or less is generally considered acceptable by most lenders.2 Some debt, like a mortgage or a small business loan, can actually be considered “good debt,” because considered it’s an investment in your future. Generally, what you want to avoid is having high levels of consumer debt (credit card debt), which typically has high interest rates and little to no advantage. If you fall in this range and consumer debt is the majority of what you owe, here are some tips to help you pay it off and keep your debt in a healthy range.

- Consider a long-term fixed payment strategy for credit cards. Instead of paying the minimum payment on credit cards, you may want to commit to paying a fixed amount each month. This can greatly reduce the money you waste on interest and the time spent paying off debt.

- If you’re carrying a balance on multiple credit cards, taking advantage of a balance transfer offer to consolidate accounts and take advantage of an intro offer such as 0% Annual Percentage Rate (APR) for a certain time period might make sense. Take a good look at the associated fees and consider making a plan to pay off the balance you transfer before the end of any promotional period.

- Another way to consolidate and pay off credit card debt is with a personal loan. One of the benefits is that you’ll have a single payment and can often save on interest, but there is also a risk of falling deeper in debt if you don’t make your payments.

Adopt a Debt Fitness Regimen

No need to panic, but a DTI ratio above 35% can make it harder to secure a loan.2 If you fall in this range, it’s probably a good idea to consider options to get your debt on a path to better health. Two common debt repayment strategies are the Snowball Method and the Avalanche Method. With the Snowball Method, you pay off your smallest debt first and can benefit from the momentum; the Avalanche Method has you focus on the debt with the highest interest rate first, which might let you pay off debt faster.3 You can learn more about both here.

Adopt a Debt Fitness Regimen

A DTI ratio above 43% often makes it difficult to get approved for a loan, and more importantly, to stay on top of day-to-day bills. If you fall in this range, it might be time to give your debt a checkup and consider implementing a plan to reduce it. It may sound simple, but to lower your DTI ratio you typically need to either decrease your debt or increase your income.

- Some techniques to decrease your debt include: refinancing high APR credit cards with a zero or low APR promotional offer, restructuring debts such as extending student loan repayments over a longer term, or asking a creditor to lower your interest rate.

- Ways to increase your income include: asking for a raise at work, taking on a side-hustle such as renting out a room for travellers or driving in a ride-share, starting a business, or generating money from a hobby, such as blogging or crafts.

If you’re feeling over your head managing your debt, you might want to consider contacting a credit counseling agency. These organizations typically offer free advice on how to tackle your debt and can help you implement a debt management plan with the goal of helping get you out of debt more efficiently. It is recommended that you pick an agency accredited by the National Foundation for Credit Counseling or the Financial Counseling Association of America.

Citations:

1 Debt.org: “Demographics of Debt” by Bill Fay, July 21, 2023 https://www.debt.org/faqs/americans-in-debt/demographics/

2 Credit Karma: “What is debt-to-income ratio and why does it matter?” by Emily Gerson, November 21, 2023 https://www.creditkarma.com/home-loans/i/debt-to-income-ratio/

3 The Balance: “What Is the Debt Avalanche Strategy?” by Justin Pritchard, January 4, 2023 https://www.thebalance.com/get-out-of-debt-with-debt-avalanche-4140758

Images and examples in this article are for illustrative purposes only.

Please note: Financial advice should be tailored to individual circumstances and the content of this article should not be viewed as recommendations. This article is not an endorsement of any particular product, service or organization; nor is it intended to provide financial, tax or legal advice. It is intended to promote awareness and is for educational purposes only. The specific applications and services noted are not necessarily endorsed by John Hancock or any of its affiliated businesses.

Advisory services offered through John Hancock Personal Financial Services, LLC, an SEC Registered Investment Adviser. Boston, MA 02210. 888-955-5432

3024487