Life insurance: what's your number?

InsureHow much life insurance do you actually need? Spoiler alert: it’s not necessarily 10x your income. We’ll break down several different methods of calculating how much life insurance you need and share some factors to personalize the numbers for you.

Step 1:

Find out your base number, which is the basic amount of life insurance coverage you need. You can use one of several methods:

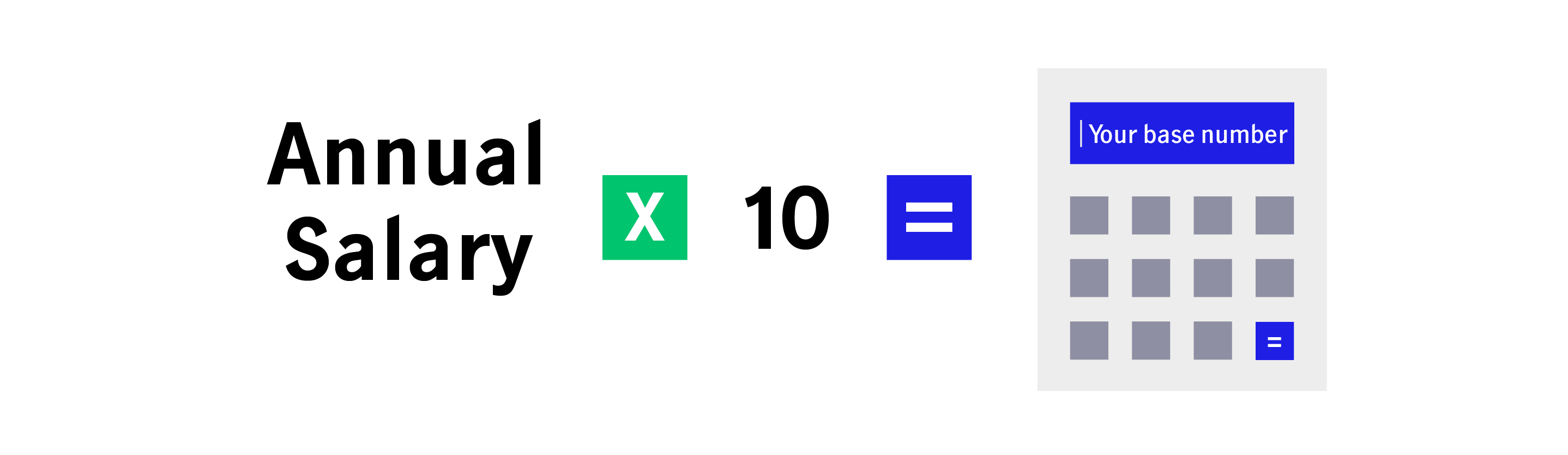

The classic 10x rule1

While this method is the most basic, it can work as a base, as long as you adjust it based on factors we’ll discuss in step 2. The 10x rule simply means you take your annual salary and multiply it by 10 to determine how much life insurance you need. So, if you make $50,000, you would use $500,000 as your base life insurance amount.

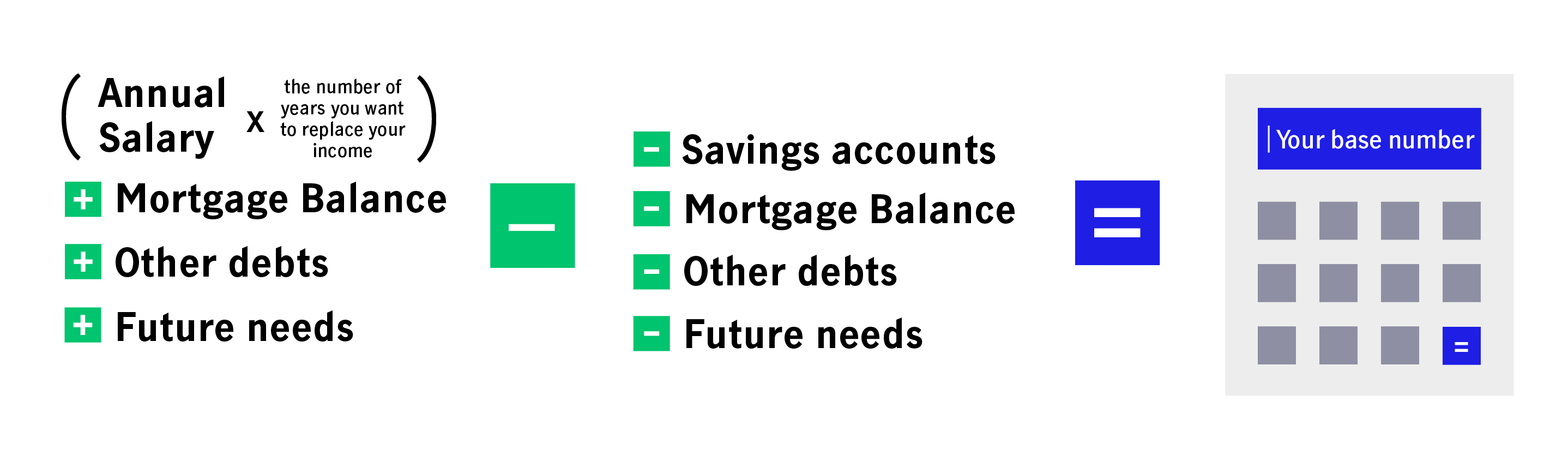

The Obligations – Earnings method2

This method takes into account your future financial assets and obligations to calculate a more accurate base number.

First, calculate your financial obligations by adding these numbers:

(+) annual salary (multiplied by the number of years you want to replace your income)

(+) mortgage balance

(+) other debts (loans, car payments, etc)

(+) future needs such as college costs

Take that total, and subtract your liquid assets:

(-) savings accounts

(-) existing college funds

(-) current life insurance

The resulting figure is your starting life insurance estimate.

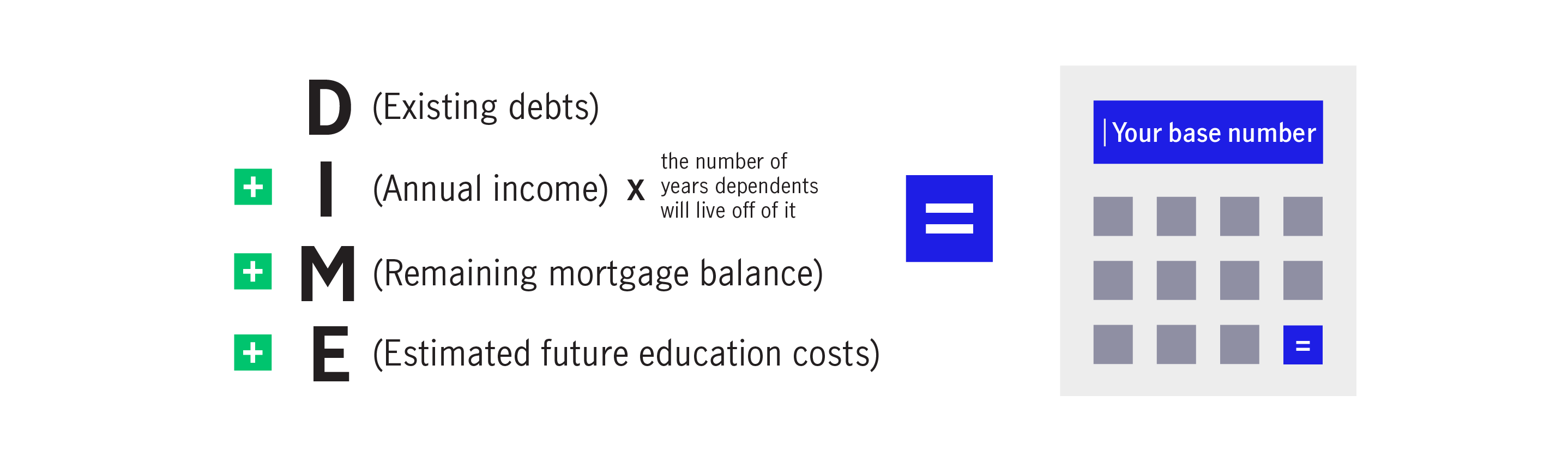

The DIME method3

DIME is an acronym that stands for Debt, Income, Mortgage, and Education expenses. Basically, you add the expenses in each category to get your base life insurance number.

To calculate yours, add the following:

(+) your existing debts

(+) annual income (multiplied by the number of years you estimate your dependents will have to live off of it)

(+) your remaining mortgage balance

(+) estimated future education costs for your children

Step 2:

Make these adjustments to tailor the numbers to your life.

You might need less life insurance if:

- You have existing life insurance. Make sure you factor in existing policies in your calculations.

- You’re single without children. With fewer people depending on your income, you may not need as much coverage. However, insurance is still a good idea to cover any end of life expenses as well as financial obligations if you have cosigners on any debts.

You might need more life insurance if:

- You’re taking care of elderly parents or could be in the future. Costs could include assisted living or in-home care.

- You want to leave a legacy gift to a charitable cause with meaning to you.

Don’t forget to factor in:

- Childcare costs, especially if you’re a stay-at-home parent.

- Education costs (if you used the 10x method).

- Funeral costs – as much as we all hate to think of it, it’s worth it to spare your loved ones the stress of covering all these expenses (an average of $10k)4

We know figuring out life insurance can seem daunting, but it doesn’t have to be. We believe it’s as much about living a better life today as it is about what you’ll leave behind tomorrow. Protecting yourself now is the first step in living a longer, healthier life. For that reason, every John Hancock insurance policy includes Vitality, a program that offers rewards and discounts for living healthy.

Citations:

1 John Hancock: “How Much Life Insurance Do I Need?” https://www.johnhancockinsurance.com/all-articles/financial-fitness/how-much-life-insurance-do-i-need.html

2 NerdWallet: “How Much Life Insurance Do I Need?” by Barbara Marquand https://www.nerdwallet.com/blog/insurance/how-much-life-insurance-do-i-need/

3 Forbes: “How Much Life Insurance Do You Really Need” by Kristin Stoller, January 13, 2020 https://www.forbes.com/advisor/life-insurance/how-much-life-insurance-do-you-really-need/

4 Funeral Wise: “How Much a Funeral Costs and Average Funeral Costs: Your Complete Guide” https://www.funeralwise.com/plan/costs/

Insurance policies and/or associated riders and features may not be available in all states.

Insurance products are issued by: John Hancock Life Insurance Company (U.S.A.), Boston, MA 02116(not licensed in New York) and John Hancock Life Insurance Company of New York, Valhalla, NY 10595.

MLINY041720127