Should I prioritize investing or paying off my mortgage?

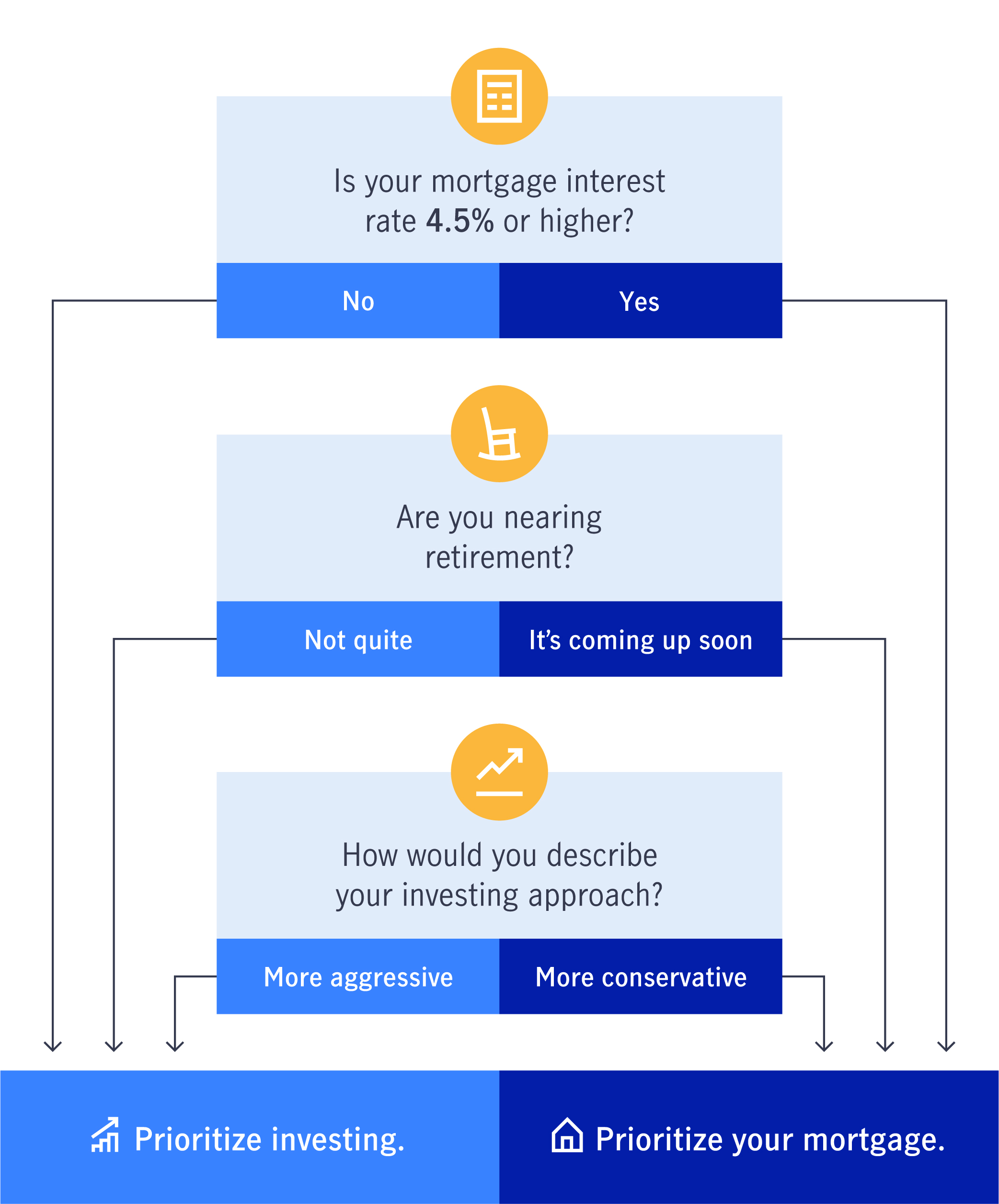

InvestOne of the most common questions homeowners ask is: Should I invest my money or pay off my mortgage? As you move closer to retirement, this question only comes into sharper focus. Though the answer is truly dependent on your individual circumstances, considering each of these questions should help you decide how to prioritize your goals.

How comfortable are you with risk?

For many homeowners, it comes down to tolerance for risk. Chipping away at your mortgage is traditionally a safer move. It’s predictable and you’ll know just how much you’re saving. On the other hand, while the average annual rate of return for stocks is 8%,1 markets do fluctuate. There’s always some risk with investing, and the appetite for uncertainty tends to decrease as people focus more on saving for retirement. Consider your comfort level and how conservative you want to be.2

Are you nearing the end of your mortgage payments?

It’s often more beneficial for newer owners to be aggressive with their mortgage payments. This is because your money is typically going towards the interest on the loan, not the principal itself. This means that any extra payments will reduce the total amount of interest owed over the course of the entire loan. However, if you’re well into a 30-year mortgage, you are likely now paying more of the principal and less interest, which can open up some room to focus on investing.

Are you paying off your mortgage with savings?

Homeowners eager to pay off their mortgage are often tempted to do so by dipping into their savings. This is a good decision for some people. However, before making that move, it’s important to fully assess your financial situation. Make sure you’ll still have enough liquid assets to cover your needs, including any unexpected expenses. Otherwise, if most of your money is tied up in your home and an emergency arises, you might need to apply for a new loan or line of credit. And that would likely cancel out any advantage you gained from paying off your mortgage.3

Do you have a high-interest rate?

Since mortgages are tied to the value of your home, they often come with relatively low interest rates. If your interest rate is 4.5% or lower4, you may want to focus on investing. Alternatively, if you have a high interest rate, you’ll want to make paying that off a priority. Also, remember that credit cards and personal loans commonly come with high interest rates. If you have debt from either, it’s best to focus on paying that off first. This allows you to cut down on that interest, saving you money in the process—money you can eventually put towards your mortgage, investing or both.5

Are you making an emotional decision?

Some people are uncomfortable with the idea of heading into retirement with debt. That’s understandable. But it shouldn’t necessarily be the driving force behind your financial planning. It’s usually best to take an objective approach and see how your portfolio is doing. If your investments are earning strong gains, you may want to make them a priority for now. Let the math, and maybe a financial advisor, guide you and be confident in that decision.6

There’s no definitive right answer when it comes to how you prioritize your investments and your mortgage payments. Consider your finances, where you are in your retirement planning, and your tolerance for risk. Once armed with that information, you’ll be well equipped to make the best decision for you and your family.

Citations:

1 Investopedia: “What Is the Average Annual Return for the S&P 500?” by J.B. Maverick, February 19, 2020 https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp

2 Smartasset: “Should I Pay Down My Mortgage or Invest?” by Derek Silva, August 21, 2019 https://smartasset.com/investing/should-i-pay-down-mortgage-or-invest

3 U.S. News: “Should You Pay Off Your Mortgage Before You Retire?” by Rodney Brooks, January 10, 2020 https://money.usnews.com/money/retirement/articles/should-you-pay-off-your-mortgage-before-you-retire

4 Smartasset: “Should I Pay Down My Mortgage or Invest?” by Derek Silva, August 21, 2019 https://smartasset.com/investing/should-i-pay-down-mortgage-or-invest

5 Nerdwallet: “Invest or Pay Off Your Mortgage? How to Decide” by Hal M. Bundrick, August 9, 2017 https://www.nerdwallet.com/blog/mortgages/invest-or-pay-off-your-mortgage-heres-how-to-decide/

6 U.S. News: “Should You Pay Off Your Mortgage Before You Retire?” by Rodney Brooks, January 10, 2020 https://money.usnews.com/money/retirement/articles/should-you-pay-off-your-mortgage-before-you-retire

Financial planning and investment advice provided by John Hancock Personal Financial Services, LLC (“JHPFS”), an SEC registered investment adviser. Investments: not FDIC insured – No Bank Guarantee – May Lose Value. Investing involves risk, including loss of principal, and past performance does not guarantee future results. Diversified portfolios and asset allocation do not guarantee profit or protect against loss. Nothing on this site should be construed to be an offer, solicitation of an offer, or recommendation to buy or sell any security. Before investing, consider your investment objectives and JHPFS’s fees. JHPFS does not provide legal or tax advice and investors should consult with their personal legal and tax advisors prior to purchasing a financial plan or making any investment.