Top tips when saving for both college and retirement

Finance 101

When it comes to saving for the future, families often wonder how to prioritize their savings goals - should you set aside money for retirement or for your children’s education? Do you have to choose? Are you on track to meet your goals? Can you afford to set aside additional funds?

Fortunately, with the right planning, you can avoid an economic tug-of-war and give your child their ideal education experience while also safeguarding your dream retirement.

Retirement Comes First

Though it’s important to strike a healthy balance, a good rule of thumb is that retirement planning should be a top priority.1 That’s because, in the long run, it’s going to cost more. While the vast majority of undergraduates complete their degree within 4 to 5 years, retirement can last 20+ years.2

1. 401(k)s

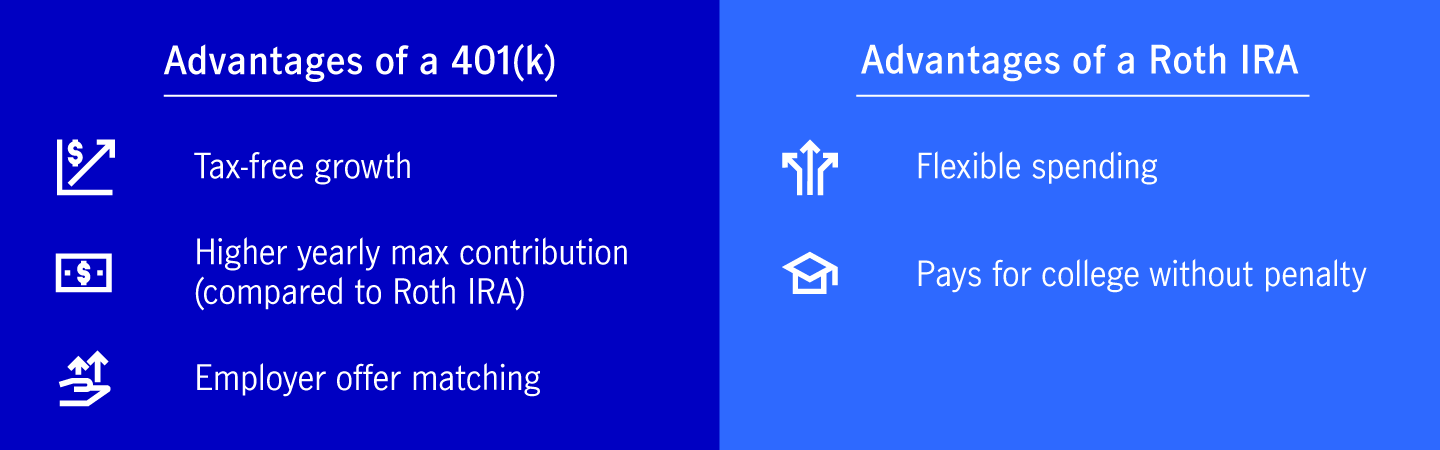

When it comes to saving for retirement, 401(k)s are a critical tool. Chances are, you’ve been taking advantage of a 401(k) for a while now, but are you maxing out your contributions? Prioritizing these savings as you enter peak earning years can make a significant difference down the line.

2. Roth IRAs

If you can’t invest in a 401(k) or are looking to diversify your savings tools, another good option is putting money into a Roth IRA. One major upside to a Roth IRA is flexibility. While it’s technically seen as a retirement vehicle, you can take out money to help pay for college expenses without facing a penalty.3 So, if you’re feeling torn between financial priorities, Roth IRAs offer a great way to compromise and gain a little peace of mind.

3. Your investment mix

Retirement may be a while away, so you have time to capitalize on asset classes such as stocks, which are more volatile but typically offer some of the best returns over time.4 You want to ensure, however, that you’re mitigating risk and protecting your financial outlook. Introducing more conservative assets, like bonds, helps balance against more volatile holdings, like stocks.

Strategizing College Savings

Start by estimating how much you need to put away for college. But don’t feel the pressure to aim for four years of tuition. Many financial advisors recommend setting a savings goal of around one third of the total cost – with the rest ideally coming from financial aid or scholarships.5 Think about what you might want to save overall and then break that down into annual (or monthly) contributions. By working backwards (and considering things like public vs. private tuition), you can get a sense of your timeline – and whether it’s time to divert additional funds towards education savings.

1. 529 Plans

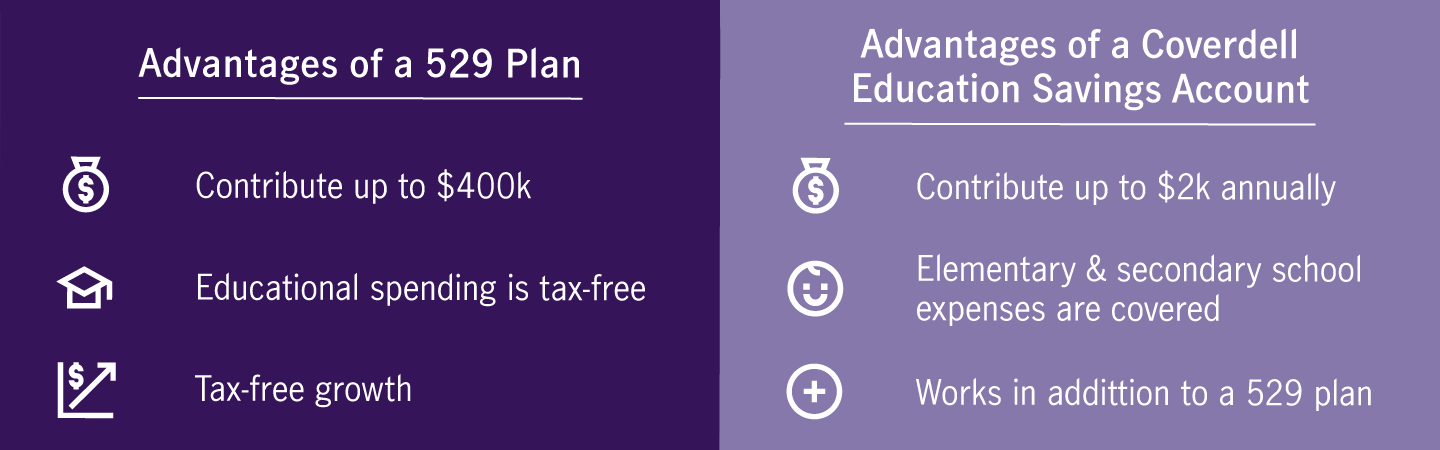

While it’s likely you already have a 529 college savings plan, here’s a refresher on its benefits. There are two major advantages to 529s. First, unlike a Roth IRA or 401(k), you can contribute as much as you like until you meet a specific balance (often $400,000).6 Second, you won’t be taxed on your investments as they grow. And finally, you can withdraw money tax-free. There is one major caveat though: The funds must go towards education expenses, otherwise you’ll face stiff penalties.6

2. Coverdell Education Savings Accounts

You might also decide to open a Coverdell Education Savings Account (also known as an ESA) in addition or as an alternative to a 529 plan. ESAs are basically like an educational trust you can establish for your child. You are limited, though, on how much you can set aside – contributions max out at $2,000 annually.7 As an added bonus, you can use your Coverdell ESA to pay for qualified elementary and secondary school expenses too8 – which might include books, academic tutoring or special needs equipment.

Ultimately, it’s important to recognize that saving is crucial regardless of your specific priorities. And that smart financial planning extends beyond your initial investments. Make a habit of regularly reviewing your finances and reevaluating your contributions. If you’re already thinking of how to balance these goals, then rest assured you’re doing something right.

Looking for further guidance on how to balance your personal financial goals? A John Hancock financial advisor is ready and willing to help.

Citations:

1 The Balance: “How Should I Prioritize My Savings Goals?” by Miriam Caldwell, March 13, 2020 https://www.thebalance.com/how-should-i-prioritize-my-savings-goals-2386146

2 NBC News: “Should you save for your retirement or your kids' college? Here's the math” by Herb Weisbaum, November 6, 2018 https://www.nbcnews.com/better/pop-culture/should-you-save-your-retirement-or-your-kids-college-here-ncna931431

3 U.S. News: “What to Know About Using an IRA to Pay for College” by Farran Powell & Emma Kerr, January 25, 2021 https://www.usnews.com/education/best-colleges/paying-for-college/articles/2016-03-30/5-things-to-know-about-using-an-ira-to-pay-for-tuition

4 Bankrate: “Saving for retirement when you’re in your 40s” by James Royal, P.h.D., November 9, 2020 https://www.bankrate.com/retirement/retirement-saving-tips-for-40s/

5 The Balance: “3 Ways to Decide How Much to Save for College” by Abby Chao, March 23, 2021 https://www.thebalance.com/deciding-how-much-to-save-for-college-4151683

6 The Motley Fool: “Should You Use a 529 Plan to Save for College?” by Matthew Frankel, CFP®, June 10, 2017 https://www.fool.com/retirement/2017/06/10/should-you-use-a-529-plan-to-save-for-college.aspx

7 U.S. News: “8 Ways to Save for Your Child's College Education” by Geoff Williams, July 1, 2020 https://money.usnews.com/money/personal-finance/articles/2014/05/20/5-ways-to-save-for-your-childs-college-education

8 Forbes: “Yes, The Coverdell ESA Still Exists - And Here's Why You Should Care” by Kathryn Flynn, April 13, 2018 https://www.forbes.com/sites/katiepf/2018/04/13/yes-the-coverdell-esa-still-exists-and-heres-why-you-should-care/#1343ef4b3986

Financial planning and investment advice provided by John Hancock Personal Financial Services, LLC (“JHPFS”), an SEC registered investment adviser. Investments: not FDIC insured – No Bank Guarantee – May Lose Value. Investing involves risk, including loss of principal, and past performance does not guarantee future results. Diversified portfolios and asset allocation do not guarantee profit or protect against loss. Nothing on this site should be construed to be an offer, solicitation of an offer, or recommendation to buy or sell any security. Before investing, consider your investment objectives and JHPFS’s fees. JHPFS does not provide legal or tax advice and investors should consult with their personal legal and tax advisors prior to purchasing a financial plan or making any investment.